Market focus

|

Adjusting to a wide variety of new demands

More than ever, organizations require financial partners that can develop strategic solutions to meet today’s evolving market needs. Siemens is positioned to adjust to a constantly shifting market environment where capital demands are less predictable. The company supports projects across a wide variety of industries, covering the full scope of a diverse and flexible financing portfolio. When customers purchase Siemens equipment or services, they may be unaware of the diverse financing options Siemens has to offer. SFS exercises a unique flexibility to invest debt, mezzanine or equity financing on the basis of fluctuating project requirements. As the needs of customers shift, SFS continues to tailor its financial solutions to more readily meet today’s market environment. It will continue to demonstrate flexibility based on the capital needs of customers. |

|

Early-stage development financing

In this phase of project development, securing adequate funding for early-stage project items is critical for power generation projects. Early-stage project developers are often thinly capitalized individuals or firms adept at site acquisition, permitting and counterparty contract negotiation. Development activities typically take 12-36 months and require early-stage capital to fund Front End Engineering and Design (“FEED”) studies (often the single largest cost during the development phase); negotiation of air, water and other permits; payments for site acquisition, land lease agreements and easements; engagement of counsel and consultants; and applications for federal, state and local financial incentives. |

|

|

|

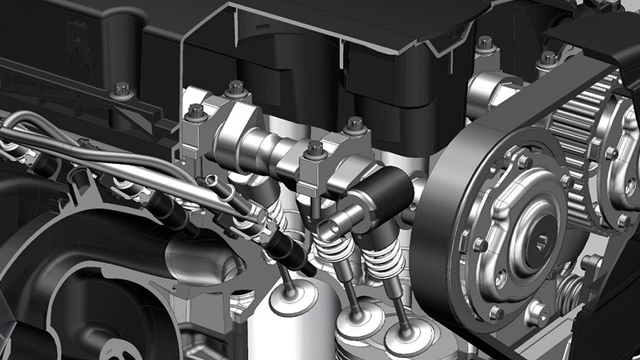

Debt solutions for the energy sector

The spectrum of Siemens debt solutions ranges from senior secured corporate loans and structured investment financing (like leases and loans) to infrastructure and project financing. In addition, its portfolio includes acquisition and growth financing, typically as syndicated loans. SFS supports private equity and corporate clients’ needs and strategic goals through senior secured loans that are tailored to all business cycles. It has the strength to structure, underwrite and hold significant positions. SFS offers both floating and fixed rate options, and is capable of a broad range of transaction sizes. SFS also tailors junior capital financing directly for clients, offering a broad suite of integrated financial solutions – including the ability to provide secured first and second lien financing, as well as mezzanine and equity capital. |

|

Equity investments to support energy projects

Through its equity financing, SFS enables projects that promise an appropriate return for Siemens and its coinvestors in terms of the project’s risk profile. Project risk profiles are determined by market risks and project specifics, such as construction and operating risks. SFS typically reserves equity capital to focus on projects that directly utilize Siemens equipment and services and generally takes a minority interest in a project, investing at financial close of project construction. SFS draws on its extensive track record in equity investment to originate, structure and execute successful investments in the energy markets with an emphasis on generating superior returns in conjunction with its coinvestors. |

|